The Commonwealth Fund national survey report found that 47% of people with insurance denials said their health conditions worsened as a result.

Listen 1:08

From Philly and the Pa. suburbs to South Jersey and Delaware, what would you like WHYY News to cover? Let us know!

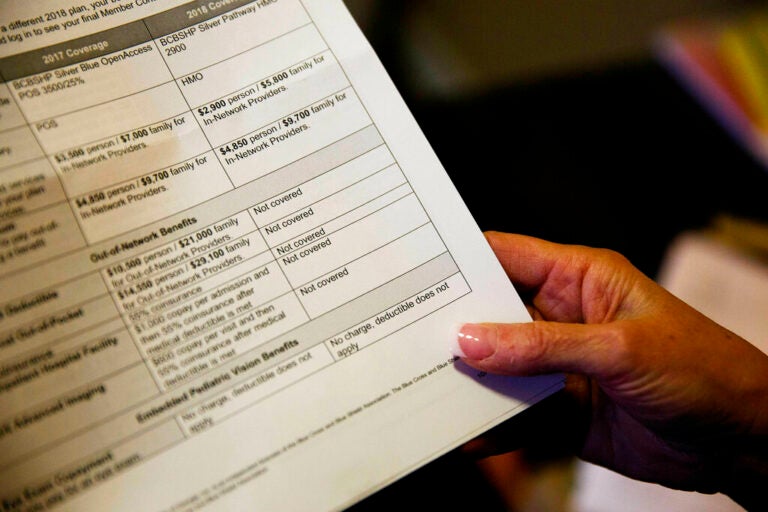

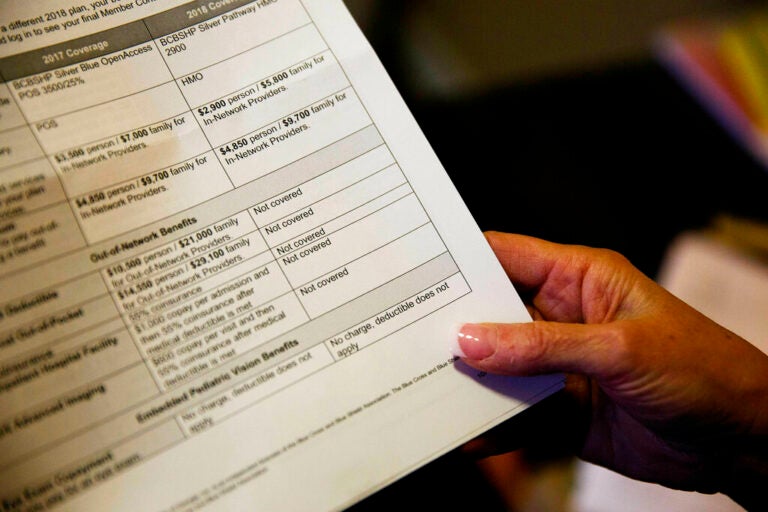

Despite laws in states like Pennsylvania, New Jersey and Delaware that aim to ensure people have access to affordable health care services, research shows that patients still receive unexpected medical bills and face insurance denials — and few of them choose to take action.

A new national survey report released Thursday by the Commonwealth Fund shows that fewer than half of people who experienced insurance denials and billing issues actually fought the decisions.

The biggest reason why? Because they didn’t know they had a right to do so in the first place.

“Consumers need a lot more information about what their rights are regarding their insurance policies,” said Sara Collins, vice president of Health Care Coverage and Access at the Commonwealth Fund.

New data from the nonprofit health care research foundation show that people who weren’t aware of their rights to challenge medical bills or coverage denials tended to be younger and have low or moderate incomes.

The report also looked at experiences and outcomes by race and ethnicity. Hispanic residents were also more likely to not know their rights in challenging bills or coverage decisions compared to Black and white residents.

States like Pennsylvania have worked to implement programs that encourage people to take action when they get denied coverage for care or get billed for potentially erroneous medical charges.

The state Insurance Department’s Independent Review Program, launched in January, assigns eligible patient cases to teams of doctors, specialists and other experts who determine if an insurance denial was correctly or incorrectly issued.

If incorrect, the review program requires that insurance companies reverse their original denials and apply coverage to a patient’s health care services, procedures, or medications.

In its first six months, the independent review program completed 194 decisions, according to state officials. In more than half of cases — 104 reviews — the original insurance denials were overturned and coverage was applied.

“In the past, too few people challenged insurer denials through internal or independent external review processes,” said Insurance Commissioner Michael Humphreys. “But the data is clear. With over half of denied claims being overturned by an independent review, health insurers can do a better job of reviewing requests for services.”